Following recent legislative clearance, the Bank of Jamaica is prepared to launch a statewide virtual currency for the first time in its history.

According to a government statement released over the weekend, the move will benefit many of the island’s almost 3 million residents who do not have bank accounts.

Before legislators adopted a bill permitting the government’s bank to create and support the digital currency on Friday publicly, Jamaica had undertaken a small-scale eight-month trial program last year.

Unlike cryptocurrencies, Jamaica’s virtual currency is issued by the government and has a fixed value that enables a dollar-for-dollar exchange.

CBDC Adoption in Jamaica

Following the testing, Andrew Holness, the country’s Prime Minister, expressed confidence in CBDC acceptance.

Within five years, Holness predicts that most Jamaicans would have adopted the digital currency, with over 70% of the population using the CBDC.

In a Bloomberg interview, Jamaican Prime Minister Andrew Holness emphasized the CBDC’s lower banking costs and inclusion, saying that the digital currency would improve government transparency by making it easier to manage public funds.

While conceding that the government must “find out how to give people access to digital devices and the internet in general,” Holness said that the government must “figure out how to provide access to smartphones and the internet in general.”

With one of the first statewide pilot projects globally, the Bank of Jamaica, the country’s central bank, has been a leader in CBDC activities. The central bank undertook an eight-month trial after working with the Irish cryptography company eCurrency Mint in March 2021.

The bank has issued the CBDC in 230 million Jamaican dollars (JMD) (1.5 million USD) to deposit-taking institutions and authorized payment service providers. The Bank of Japan then issued 1 million JMD (6,500 USD) in CBDC to its banking department workers and another 5 million JMD (32,000 USD) to the National Commercial Bank, its largest financial institution.

In the first quarter of this year, BoJ plans to add two new wallet providers to the CBDC, followed by a statewide deployment. The central bank also intends to test transactions between clients of different wallet providers to ensure compatibility.

CBDC Development Worldwide

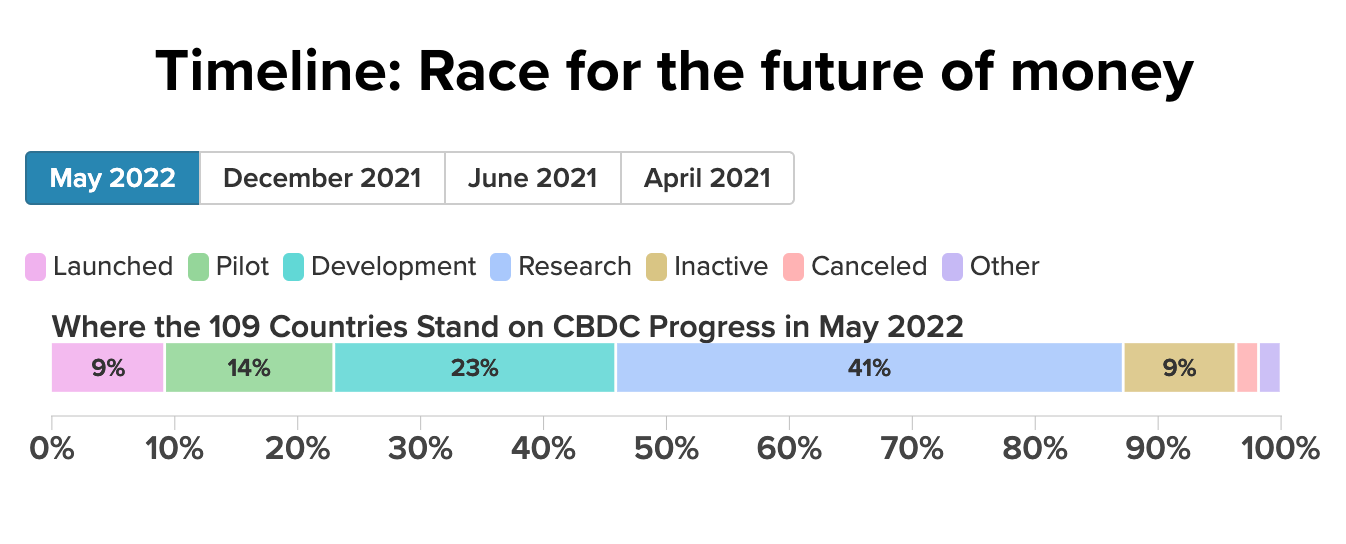

A CBDC is being considered by 105 countries, representing more than 95% of the world’s GDP as of May 2022. In comparison, only 35 countries were exploring a CBDC in May 2020. The number of countries in advanced exploration has reached a new high of 50. (development, pilot, or launch).

A digital currency has been established in ten nations, with China’s trial program slated to expand in 2023. The JAM-DEX is the most recent CBDC to be launched by Jamaica. In October 2021, Nigeria, Africa’s largest economy, launched the CBDC.

At the same time, several countries are exploring alternative international payment methods. Following the imposition of financial sanctions on Russia, the trend is likely to accelerate. There are nine cross-border wholesale CBDC tests (bank-to-bank) and three cross-border retail CBDC projects.

The USand the UK are the G7 economies furthest behind on CBDC development. The European Central Bank has announced that a digital euro will be available by the middle of the decade.

A CBDC is being considered by 19 of the G20 countries, with 16 being in the development or pilot stage, with South Korea, Japan, India, and Russia making great development.

However, the financial system may confront a serious interoperability issue in the near future. The development of many CBDC models has heightened the need for worldwide standardization.