The Indian finance minister Nirmala Sitharam will present the Union Budget 2022-23 today on 1st February. (1).

While our national budget is typically associated with the presentation of our finance minister in Parliament, it is a small portion of the entire exercise. There is much more to it.

The entire budget process is quite lengthy and drawn-out. It is important to understand the different steps and stages of the budgeting process to understand the Indian Union Budget as a whole. Therefore, we have decided to explain a beginner’s guide to understand it ahead of the budget presentation.

Introduction to the Indian Union Budget

The Indian Union Budget, or the Annual Financial Statement of India, according to Article 112 of our constitution (2), is the annual budget of our country.

Our government presents it on 1st February to be materialized before starting the new financial year in April. It is also worth highlighting that until 2016, the finance ministry used to present the budget on February’s last working day in the Parliament.

The finance ministry presents the budget using the finance bill, which needs to be approved by Lok Sabha before coming into effect.

There is also an interim budget, different from “Vote on Account.” The “Vote on Account” deals with only the expenditure side of the government’s budget. On the contrary, the interim budget offers a complete financial statement, similar to the full budget.

There are no laws to disqualify the Union government from introducing tax changes. However, governments avoid making major changes in the income tax laws during an election year (3).

Since 1947, there have been 73 annual budgets, 14 interim budgets, and four mini-budgets or special budgets (4,5).

Interim Budget

The government presents an interim budget when it doesn’t have enough time to present a full budget, and it mostly happens when a general election is around the corner. Hence, as per tradition, the government leaves the task of framing the full budget to the incoming dispensation after getting the election results.

For instance, in February 2019, Piyush Goyal, then finance minister, had presented an interim budget a few months before the national election (6).

A Union Budget that our government presents is only valid until the end of the fiscal year, 31st March.

In a simple explanation, it only offers the government spending rights until that date. Hence, if the government cannot present a full budget before the end of the financial year, it will need parliamentary approval to incur expenses when the new financial status passes a new budget. Therefore, it is named as “interim budget.”

Vote On Account

Via the interim budget, our Parliament passes a vote-on-account, which offers the government temporary permission to meet the administration’s expenses until the elections.

While it is only valid for two months, the government can extend it.

The difference between the Vote on Account and an interim budget is that an interim budget is like the full budget; however, only temporary. Like the Union Budget, it has a complete set of accounts, including receipts and expenditures. And similar to the full budget, governments present the estimates for the whole year.

As we mentioned, during the election year, any government avoids announcing any major schemes or tax changes in the interim budget, even though it is not prohibited as per the constitution.

On the other hand, a vote on an account contains only the expenditure side of things, and it is passed in Parliament without any formal discussion.

Read Also: Union Budget 2022; Here’s What Startup Founders are Expecting

Traditions Around Union Budget

Budget Announcement Time

Until 1999, the government announced the Union Budget at 5:00 pm on the last working day of February. Our country had inherited the practice from the colonial era. The real agenda behind it was to offer Britishers the time of 11:30 am, a relaxing time at their location.

Another reason is, until the 1990s, all budgets appeared to want to raise taxes. And a presentation in the evening offers producers and tax collecting agents the night to work out the price changes.

Yashwant Sinha, then the Indian finance minister in the government led by BJP under the honorable Prime Minister Shri Atal Bihari Vajpayee, finally changed the colonial ritual by announcing the Union Budget at 11 was in 1999, and the tradition continued from 2001 (7).

Budget Announcement Date

In 2016, Arun Jaitley, then Finance Minister of India, emancipated our country from another colonial-era obligation of delivering the Union Budget on the last working day of February. The NDA government, led by the BJP under the leadership of Shri Narendra Modi, the present honorable prime minister of India, announced that they would present the budget on 1st February.

In addition, the present government had also announced a Rail Budget merger with the Union Budget, which was presented separately for the last 92 years (8, 9).

Budget Briefcase and Halwa Ceremony

The Finance Ministry starts printing the budget documents one week before presenting them to Parliament with a traditional “Halwa Ceremony.” In this custom, the government prepared halwa in large quantities and served them to the officers and support staff involved with the process. The staff also remains isolated and stays within the North Block office until the final presentation of the Union Budget.

The government serves the halwa as part of the Indian tradition of having something sweet before starting an important work (10).

Until 2018, the Finance minister carried a budget in a leather briefcase as a part of the custom established by the first Finance Minister of India, Mr. RK Shanmukham Chetty. Nirmala Sitharam broke this tradition in July 2019 by carrying it in a Bahi Khata (11).

However, last year, she presented the budget paperless for the first time amid the ongoing coronavirus pandemic in India (12, 13). Bahi Khata, a ledger wrapped in red cloth, is now completely removed with this move. The move is also said to be strengthening Prime Minister Narendra Modi’s ambitious mission – Digital India.

Read Also: A Summary of the Union Budget 2021-22

Union Budget’s Multidimensional Aspects

As we mentioned, the entire budgetary process is quite lengthy, and it is important to understand its different stages and steps.

The Union Budget has four stages:

- Estimates of Revenues and Expenditures

- Estimate of Deficit

- Narrowing of Deficit

- Presentation and Approval of the Budget

Hence, you first need to understand any budget statement of anticipated Expenditure and receipts.

Hence, it is important to understand where the government raises money and spends it. And since the Union Budget is a complex process, there are several documents the government gives during the budget presentation (14).

Read Also: Prarambh, Indian Startup Ecosystem, and Modi Government

Step 1: Estimates of Revenues and Expenditures

Income Sources for the Indian Government

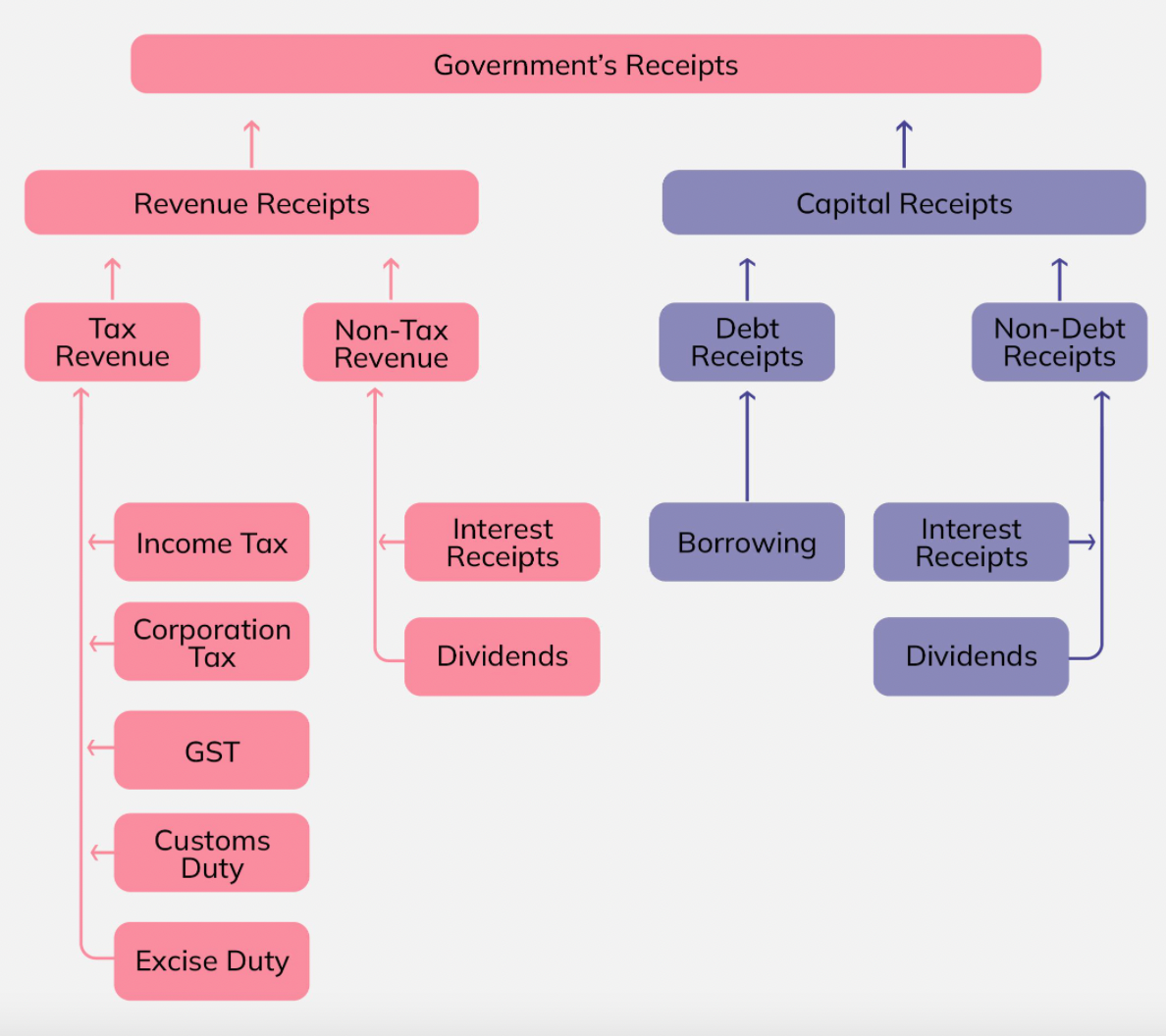

There are several ways our government raises resources. Also, we can categorize them in multiple ways.

Below is the break of our government’s capital and revenue receipts.

Tax Revenue

- Income tax: The Income-tax Act of 1961 imposes a tax on the income of individuals, firms, and other entities other than corporations. Other taxes are included under this heading. The most notable is the Securities Transaction Tax, levied on transactions in listed securities conducted on stock exchanges, more often known as the stock market.

- Corporation Tax: The Income-tax Act of 1961 imposes a tax on the income received by businesses.

- GST, Goods and Services Tax: Except for gasoline, alcoholic liquor for human consumption, and a few other products, GST is a tax on the supply of goods or services or both. It was first introduced On 1st July 2017.

- Custom Duty: This tax is imposed on items traded internationally or across borders.

- Excise Duty: This tax is levied on items that are manufactured. Since GST implementation in 2017, excise duty has been imposed only on the manufacture of non-GST items.

- Wealth Tax: A tax on the total amount of wealth owned at a certain point in time. In general, the tax code specifies which assets are taxable under the wealth tax and how they should be valued for tax purposes. In India, there was formerly a wealth tax. However, it was abolished in 2015-16 because of a lack of revenue collection and a high collecting cost.

Non-Tax Revenue

- Interest: This is the amount of interest received by the federal government on loans made to states and union territories.

- Dividends and Profits: When public sector firms and the Reserve Bank of India transmit their income to the government, this is the amount received.

- Other Non-Tax Revenue: It refers to the government’s charges for specific services, such as financial services, general services, and so on. Railway income, postal fees, shipping, civil aviation, user fees, and other fees are examples of such costs.

Non-Debt Capital Receipts

- Disinvestment: It is the sales of government-owned assets in part or full ownership, including public sector enterprise, land, and others.

- Loan Recovery: It refers to the recovery of the loans that the union government offers to Union Territories and State governments.

Debt Capital Receipts

- Burrowing: It is the amount that the government borrows and needs to repay in the future, also known as debt receipts.

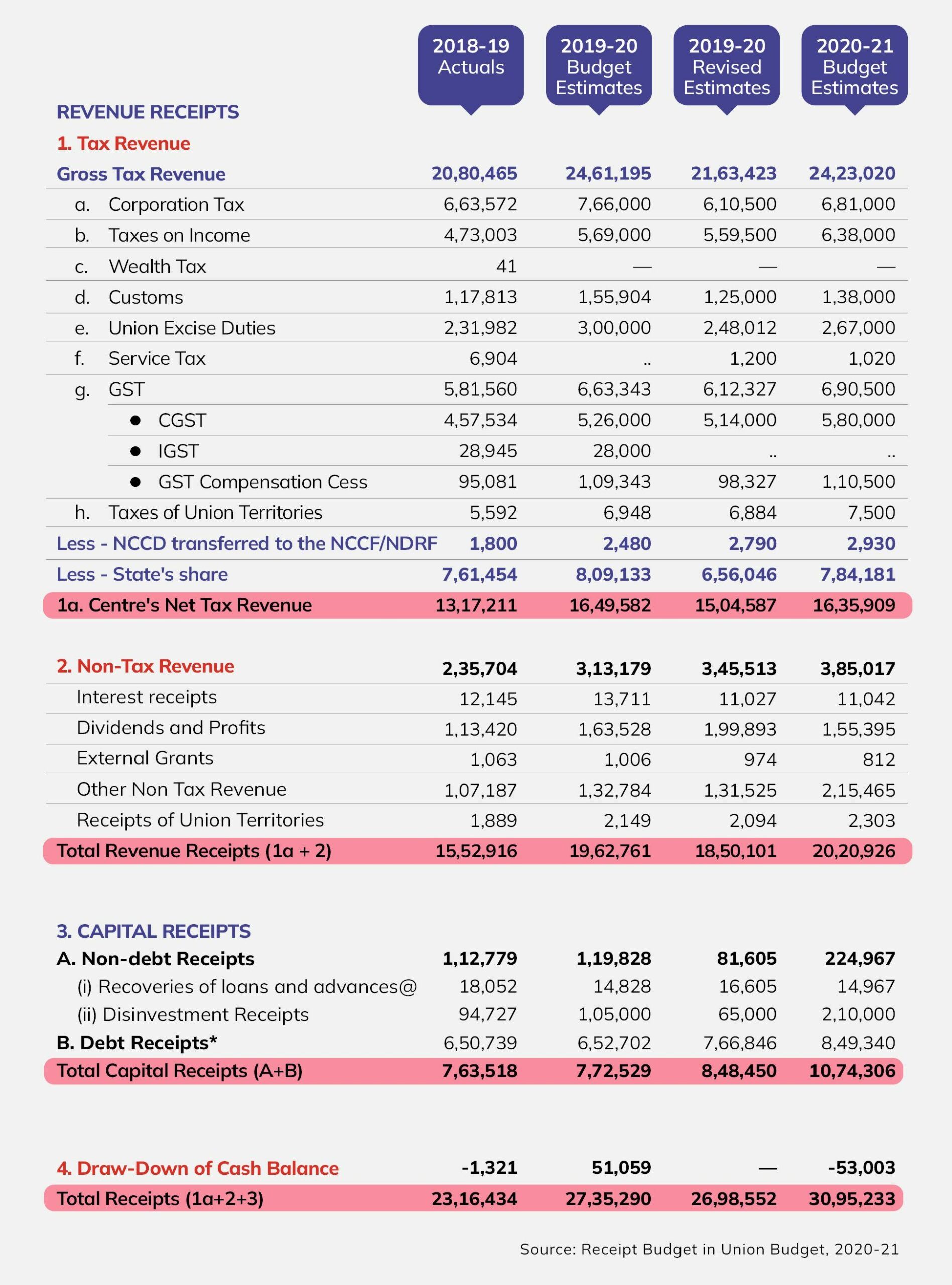

Since the government’s receipts budget has multiple descriptions and deep dives for each entry, a summarized snapshot of the Union Budget 2020 actual receipts is below.

Read Also: Emerging Indian Startup Ecosystem, Red Flag, Government Role

Governments’ Expenditure

Similar to receipts, there are multiple ways to classify our government’s expenditures, and there are also classifications at the ministry and sectoral levels.

Nonetheless, in this article, we will discuss three types of classification:

- Voted Vs. Charged

- Classifications in the “Budget at a Gland” document

- Ministry-wise Classification

Voted Vs. Charged

‘Voted Expenditure’ is an expenditure that must be approved by Parliament, whereas ‘Charged Expenditure’ is an expense automatically debited from India’s Consolidated Fund.

Voted Expenditure is part of the budget, and the government decides how much it wants to spend. It covers things like education, health, sanitation, and infrastructure, among other things. On the other hand, Charged Expenditure is not subject to government approval or voting. Its examples include interest payments, the salary of the Lok Sabha speaker, the President, etc.

Classifications of Expenditure in the “Budget at a Glance”

The below image depicts the break up of the government expenditure as classified in the Budget at a Glance document in Union Budget 2020.

Ministry-Wise Spending

We can also classify the union government’s Expenditure as per its ministries. It is worth noting that not all Expenditure goes through ministries, like transfers to states and interest payments. However, we can classify the remaining as per its ministries.

Ministry-level expenditure data is useful since it provides insight into the government’s priorities. It is also possible to look at the year-over-year change to understand the shift in the government’s priorities.

Read Also: Indian Rupee is Declining; Here is Everything You Need to Know!

Budget Documents

The Union Government is required by Article 112 of the Constitution to present an account of India’s receipts and expenditures to both Houses of Parliament.

The ‘Annual Financial Statement’ is the name given to this statement. The Union Budget includes a variety of other documents, reports, and statements in addition to the Annual Financial Statement.

The many documents also reflect the wide range of topics the Union Budget must address. While this list provides an overview of all major documents/statements, depending on the situation, one can dig further into one or more documents to obtain the information necessary (15, 16).

The following is a list of all the documents included with the Union Budget:

Read Also: Everything You Need to Know About the Indian Market in 2022

Step 2: Estimates of Deficit

After the revenue and expense estimates are completed, they are matched. It gives a preliminary estimate of the revenue deficit needed to fulfill forecasted expenditures. The government then decides on the best level of borrowing to cover the deficit in conjunction with the top economic advisor.

The figure for foreign borrowings is known since much of the government’s external borrowing is made up of bilateral and multilateral aid, which is known when budget exercises are conducted. The amount of domestic borrowing is determined partly by the government’s intended level of fiscal deficit. A portion of the revenue shortfall is left blank, replaced by ad hoc treasury bills.

Read Also: How Can Indian Startups Emerge Stronger in 2022?

Step 3: Deficit Narrowing

Any leftover gap is addressed after the determination of fiscal deficit targets and the total budget deficit, if possible.

It is done through a change in tax rates, keeping in mind the fiscal incentive structure the government seeks to implement to boost growth in various sectors. Adjustments to the Expenditure are made following the initial plans; in most cases, the ministry also needs to update the plan expenditure if any changes are required.

Interest payments, subsidies, and administrative expenses are included in non-plan expenditures. Because of the political sensitivity inherent in decreasing subsidies, the government’s non-plan expenditure is resistant to change. After pre-emption, the plan expenditures that are cut have already been made for non-plan expenses.

Read Also: Challenges in the Indian Startup Ecosystem

Step 4: The Budget

According to the Indian constitution, Parliament’s approval is paramount when it comes to the Union Budget. Article 112 of the Indian constitution needs the Union administration to present an annual financial statement of estimated receipts and expenditures to the Houses of Parliament.

Only with the approval of both houses of Parliament can it charge taxes or dispense funds. However, the minister of finance must initiate the proposal for taxes or expenditure in the Council of Ministers. The Finance Minister makes a financial statement to Parliament describing the central government’s expected receipts and expenditures for the future fiscal year and an assessment of the current fiscal year.

The government can only withdraw money from the Consolidated Fund of India with Parliament’s approval under Article 114 of the Constitution. Hence, the Budget Bills must be passed by Parliament, and it gives the executive the authority to spend money.

The government is prohibited from collecting taxes without legal permission under Article 265 of the Constitution. As a result, the government drafted the Finance Bill. The Bill has the power to charge new taxes, amend current tax structures, or extend existing tax structures beyond the period already granted by Parliament.

Then, the legislation is sent to the Rajya Sabha for consideration. On the other hand, the Lok Sabha is not bound to accept the suggestions, and the Rajya Sabha cannot prevent the measures from being passed. When the President signs the bills, they become law. The Lok Sabha has no authority to enhance the executive’s funding request or authorize new spending.

The budget recommendations go into effect on 1st April. Between the presentation and the effective date, the Lok Sabha has two months to evaluate and amend the government’s budget plans.

Most of the time, this does not occur, and the Parliamentary review of ideas and budget passage occurs in May, far after the start of the next fiscal year. Because the planned budget must take effect on 1st April, the government normally seeks interim approval to cover unexpected expenses that must be paid while the budget is being approved.

As discussed, it is known as a vote-on-account, and the sanctions imposed by the vote-on-account are automatically overridden if Parliament approves the Budget.

Read Also: How India is Collaborating with Foreign Nations for its Startup Ecosystem

The Importance of Union Budget

As you may already know, the Union Budget is allocated for the upcoming fiscal year, which begins on 1st April and concludes on 31st March of the following year. The overall goal of the Union Budget is to achieve our country’s rapid and balanced economic growth while also ensuring social justice and equality.

The government’s spending and income collection are laid out in the yearly financial statement.

Its goal is to eliminate economic inequality by promoting balanced development and price regulation. It entails proper resource allocation through good governance and maximization of welfare through well-designed policies. The budget lists revenue sources (taxes, for example) that will be used to fund productive activities and welfare programs.

It not only gives industries a roadmap to help them develop and participate in India’s growth, but it also offers us a sense of disposable money and actual spending power (17, 18).

The primary objectives that illustrate the importance of the Union Budget in India are listed below.

- Ensure Efficient Allocation of Resources: It is critical to make the best use of existing resources in its best interests. Allocating resources optimally aid the government’s profit maximization while promoting public welfare.

- Help Reduce Unemployment and Poverty Level: Another goal of the Union Budget is to eradicate poverty and provide employment possibilities. It would ensure that every citizen has access to necessities such as food, shelter, clothing, and medical and educational services.

- Help Narrow Disparities in Wealth and Income: Subsidies and taxes in the budget help to influence the distribution of income. It ensures that the wealthy pay a high tax rate, decreasing their disposable income. On the other hand, the lower-income group gets taxed at a reduced rate to ensure that they have enough money.

- Keep Inflations in Check: The Union Budget also contributes to controlling economic swings. It ensures that inflation and deflation are properly managed, resulting in economic stability. Surplus budget policies are used during inflation, while deficit budget policies are used during deflation. It contributes to the economy’s price stability.

- Change in the Tax System: The Union Budget also specifies any potential adjustments in the country’s direct and indirect taxation, affecting the rates and brackets of income taxation.