Suzlon Energy, a leading wind energy solutions provider, is one of India’s largest renewable energy companies. The company is engaged in the development, manufacture, sale, and installation of wind turbine generators (WTGs) and related components. Its shares are listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). In this article, we provide an analysis of Suzlon Energy’s share price and performance.

In addition, the company’s cash flows have been weak in recent times. In the quarter that ended June 2020, the company reported a negative operating cash flow of INR 2,100 crore. This further adds to the company’s financial woes.

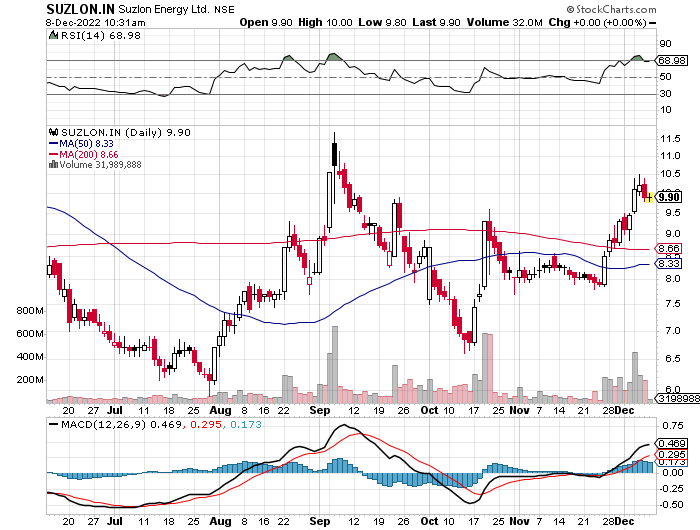

Suzlon Energy’s share price has seen a rollercoaster ride in recent months. In mid-August, the company’s share price was around INR 5.5 on the NSE. By the end of August, the share price had risen to INR 6.5. However, in early September, the share price started to decline and reached a low of INR 4.3 on the NSE by mid-September.

Since then, the share price has been on an upward trajectory and is currently trading at around INR 5.5 on the NSE. This represents a return of over 28% since its low point in mid-September.

However, despite the recent upturn in Suzlon Energy’s share price, the company is far from out of the woods. In the quarter that ended June 2020, the company posted a net loss of INR 1,837 crore. This is a significant increase from the loss of INR 571 crore reported in the previous quarter.

The company’s total debt stands at INR 15,000 crore, a figure that has been rising steadily over the past few years. This has put immense pressure on the company’s financial position. The company’s debt-to-equity ratio is also high at around 5.4.

In addition, the company’s cash flows have been weak in recent times. In the quarter that ended June 2020, the company reported a negative operating cash flow of INR 2,100 crore. This further adds to the company’s financial woes.

Despite these challenges, the company has been able to secure some major orders in the past few months. In April, Suzlon Energy secured an order for the supply of 300 MW of WTGs from a leading power producer in India. This is a significant order and is likely to boost the company’s revenue and cash flows in the coming quarters.

Overall, Suzlon Energy’s share price has seen an upturn in recent months, driven by the company’s recent orders and improved financial position. However, the company still faces significant challenges in terms of its debt burden and weak cash flows. Investors should closely monitor the company’s performance in the coming quarters before making any investment decisions.

In conclusion, Suzlon Energy is one of India’s leading renewable energy companies, and its share price has seen an upturn in recent months. However, the company is still facing significant financial challenges, and investors should closely monitor its performance before making any investment decisions.